How Does XRP's Whale Activity Affect Its Market Cap and Price in 2025?

XRP's $150.6 billion market cap affected by 5.48% price drop

A 5.48% decline in XRP's price would significantly impact its substantial $150.6 billion market capitalization, reducing it by approximately $8.3 billion to $142.3 billion. This potential volatility aligns with recent price movements observed in October 2025, when XRP experienced a dramatic 16% daily loss between October 10-11, plummeting from $2.82 to $2.36.

Recent market data reveals concerning patterns for XRP investors:

| Time Period | Price Change | Market Impact |

|---|---|---|

| Oct 10-11, 2025 | -16% | $11 billion loss |

| October 30, 2025 | -6.5% | Nearly $11 billion wiped |

| Potential 5.48% Drop | -5.48% | $8.3 billion reduction |

XRP's price has demonstrated extreme volatility in Q4 2025, with predictions suggesting fluctuations around the $2.40 price point through November. Technical analysis indicates resistance levels between $2.45-$2.55, with support around $2.20 following the recent market correction.

The potential 5.48% drop follows a broader pattern of cryptocurrency market corrections, with institutional futures open interest decreasing from $9.0 billion to $8.85 billion during recent pullbacks. Long liquidations have substantially outpaced short positions during these market movements, reaching $21 million versus just $2 million for shorts during peak volatility periods.

Whale activity: 900,000 XRP sold in 5 days impacting price

Recent on-chain data reveals significant whale activity in the XRP market, with large holders offloading approximately 900,000 XRP tokens over a five-day period in early November 2025. This sell-off coincided with a notable price decline, pushing XRP from above $2.90 toward the critical $2.20-$2.30 support zone.

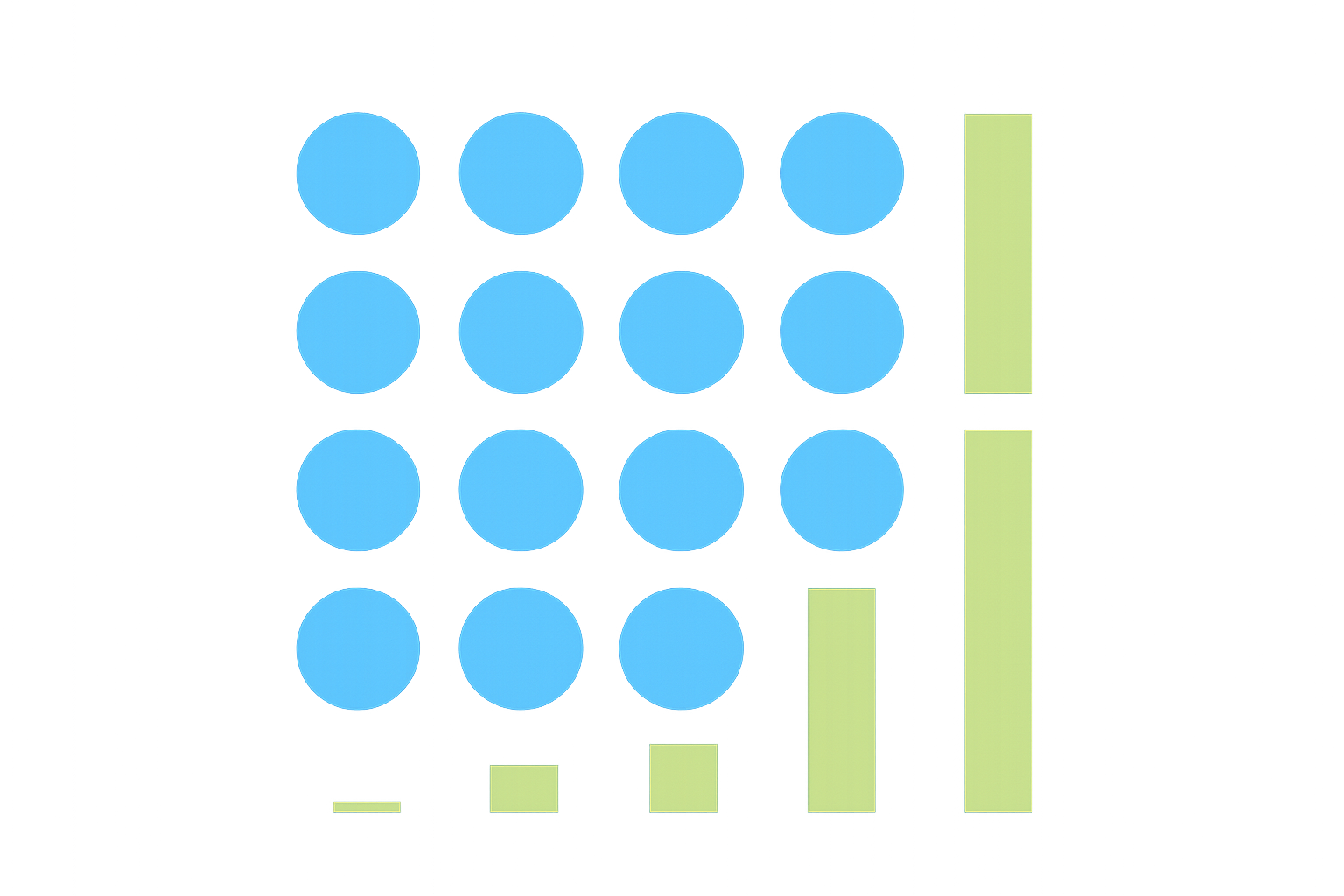

The market reaction to this whale movement was substantial, with XRP experiencing a 7% daily decline and significant price volatility as shown below:

| Period | Price Movement | Support Level |

|---|---|---|

| Before Sell-off | $2.90+ | Strong above $2.80 |

| During Sell-off | -7% daily | $2.20-$2.30 zone |

| Current | $2.349 | Testing new floor |

While this sell-off has amplified bearish sentiment, market analysts note that the 900,000 XRP represents a relatively small portion of XRP's 60.1 billion circulating supply. Exchange inflow data from late October shows declining whale-to-exchange transfers, potentially easing further selling pressure if demand remains stable.

This market activity coincides with XRP approaching a "death cross" formation, where the 50-day moving average crosses below the 200-day line, often considered a bearish technical indicator. Despite short-term volatility, XRP's fundamentals remain strong with its established position as the 4th ranked cryptocurrency by market capitalization at $141.19 billion.

Exchange net inflows and outflows influencing $4.2 billion holdings

XRP exchange flows have become a critical metric for tracking market sentiment and price direction in 2025. Recent data shows that the current exchange-held XRP stands at approximately $4.2 billion, representing significant liquidity in the ecosystem. The on-chain metrics from Q1 2025 reveal compelling evidence of accumulation, with daily trading volumes averaging $1.73 billion, up from $1.42 billion in the same period last year.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Daily Trading Volume | $1.42B | $1.73B | +21.8% |

| ETF Inflows | $0 | $1B+ | New market |

| Exchange Net Flow | Negative | Positive | Sentiment shift |

Santiment and Coin Metrics data confirm that major exchanges are experiencing net positive inflows, contradicting previous outflow patterns. This shift coincides with the introduction of XRP ETFs in March 2025, which have attracted over $1 billion in investments. Notably, whale addresses have accumulated more than $560 million in XRP during this period, signaling strong institutional confidence despite price volatility.

The current $4.2 billion exchange holdings figure represents approximately 3% of XRP's total market capitalization of $141.19 billion, indicating substantial liquidity available for trading while maintaining a healthy off-exchange supply that reduces sell pressure.

FAQ

Is XRP still a good investment?

Yes, XRP remains a promising investment. With regulatory approval for ETFs and recent price highs, XRP shows strong potential for growth in the crypto market.

How much will 1 XRP be worth in 5 years?

Based on current trends, 1 XRP could potentially be worth around $27 in 5 years, with further growth possible depending on adoption rates.

Can XRP hit $100 dollars?

Yes, XRP could potentially hit $100. While ambitious, increased adoption and utility in global payments could drive significant price growth by 2025.

Will XRP reach $1000 dollars?

While highly ambitious, XRP reaching $1000 is not impossible in the long term. It would require significant market growth and adoption over many years. Current predictions suggest it's unlikely in the near future.

How Token Unlocks Could Affect Cryptocurrency Values in 2025

What Factors Are Driving Cryptocurrency Price Volatility in 2025?

What is the Current Price of Pi Network and How Volatile is it in 2025?

How Will Cryptocurrency Price Volatility Evolve in 2030?

How Does On-Balance Volume (OBV) Predict Price Trends in Crypto Trading?

How Does JELLYJELLY's Market Concentration Affect Its Liquidity and Fund Flows?

Moving Average Ribbon

How to Margin Trade Crypto: A Comprehensive Guide

What Is Open Interest?

Pi Coin Price Prediction 2050: What to Expect

Analysis of Reasons Behind Solana's Price Decline