Blume 2000 Gutscheincode in Crypto Finance Explained

Concept Introduction

In the rapidly evolving landscape of blockchain and cryptocurrency, specialized terms often emerge that blur the lines between traditional commerce and decentralized technology. In recent years, a term gaining significant traction in crypto finance conversations is 'blume 2000 gutscheincode'. Understanding this phrase in the context of crypto and blockchain has become increasingly important for investors, developers, and promotion strategists.

At its core, a 'gutscheincode' is the German word for voucher code or promotional code, while 'Blume 2000' references an established flower and plant retailer in Europe. However, within the digital assets sphere, 'blume 2000 gutscheincode' conceptually refers to blockchain-enabled digital voucher systems—tokenized promotional codes that enhance customer engagement, drive adoption, and fundamentally transform how discounts, rewards, and branded incentives are distributed and redeemed across digital ecosystems.

This innovative approach represents a paradigm shift from traditional coupon systems to programmable, verifiable, and tradeable digital assets. By leveraging blockchain technology, these voucher codes gain properties previously impossible in conventional systems: cryptographic security, transparent provenance, peer-to-peer transferability, and automated execution through smart contracts. The implications extend far beyond simple discount mechanisms, touching on loyalty programs, gamified marketing campaigns, and even new forms of digital collectibles that carry real-world utility.

Let's venture deeper into this innovative intersection of discounts, decentralized finance, and digital ownership to understand how blockchain technology is revolutionizing promotional strategies and customer engagement models.

Historical Background and Origin

The Roots of Voucher Codes in Traditional Finance

Voucher codes and coupons have been fundamental marketing instruments in retail for over a century, serving as powerful tools to attract new customers, reward loyal patrons, and stimulate sales during specific periods. Traditional voucher systems evolved through several phases: from physical paper coupons distributed through newspapers and direct mail in the early 20th century, to digital codes shared via email campaigns and online platforms in the internet era.

These conventional systems, while effective, suffered from inherent limitations: susceptibility to fraud through code duplication, lack of transparency in distribution and redemption tracking, inability to transfer unused vouchers, and significant administrative overhead in managing campaigns across multiple channels. Businesses struggled with coupon abuse, while customers often lost or forgot about their promotional codes before expiration.

Enter Blockchain: The Tokenized Revolution

With the emergence of blockchain technology and the proliferation of smart contract platforms, the age-old coupon concept was fundamentally reimagined. Pioneering projects in the blockchain space began experimenting with representing discounts and limited-time offers as on-chain digital assets: non-fungible tokens (NFTs), redeemable ERC-20 tokens, or cryptographically-secured codes managed through decentralized smart contracts.

These blockchain-based digital vouchers introduced revolutionary capabilities: verifiable authenticity through cryptographic signatures, transparent and immutable transaction histories, novel secondary market opportunities where unused vouchers could be traded or sold, and programmable conditions that could automatically trigger based on predefined criteria. The technology eliminated the trust requirements inherent in traditional systems, replacing them with cryptographic proof and transparent execution.

Early adopters in the e-commerce and retail sectors recognized that blockchain vouchers could solve long-standing problems while creating entirely new engagement models. The ability to track voucher lifecycles from creation through redemption, prevent double-spending through consensus mechanisms, and enable peer-to-peer transfers opened unprecedented possibilities for creative marketing strategies.

Blume 2000 Gutscheincode: A Prototype Trend

The term 'blume 2000 gutscheincode' came to be associated with pioneering blockchain initiatives by retailers and e-commerce businesses—both within floristry and across diverse sectors—that leveraged tokenized voucher solutions to enhance customer experiences. Forward-thinking companies identified strategic opportunities to integrate blockchain technology by issuing digital coupons that could be seamlessly traded, transparently tracked, reliably redeemed, and even resold on secondary markets.

This approach represented more than a technical upgrade; it fundamentally reimagined the relationship between businesses and customers in promotional contexts. By treating vouchers as digital assets with inherent value, companies could create viral marketing effects, build engaged communities around their brands, and gather unprecedented insights into customer behavior and preferences. The 'blume 2000 gutscheincode' concept thus became emblematic of a broader movement toward programmable, trustless loyalty and incentive systems that bridge traditional commerce with decentralized finance principles.

Working Mechanism

How Do Blockchain-Enabled Voucher Codes Function?

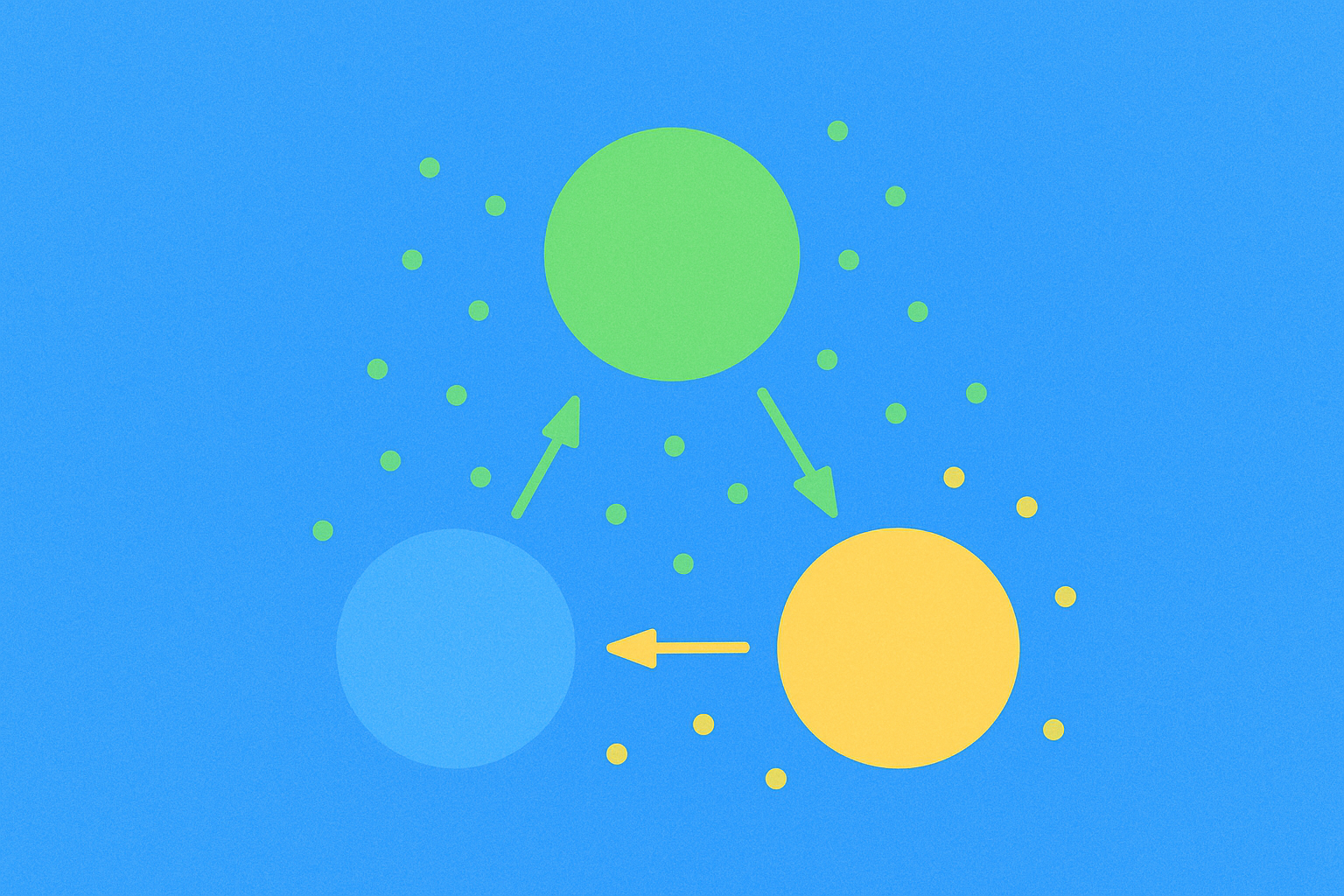

The transition from traditional promotional codes to tokenized blockchain vouchers represents more than just a technical upgrade; it unlocks powerful new possibilities for businesses and users alike. Understanding the technical architecture and operational flow of a 'blume 2000 gutscheincode'-type system reveals how blockchain technology fundamentally transforms promotional mechanics.

Token Creation and Minting Process: A business initiates a campaign by minting a specific batch of unique tokens representing promotional codes using a blockchain network such as Ethereum, Polygon, or Binance Smart Chain. These digital assets can take various forms: non-fungible tokens (NFTs) for unique, collectible vouchers; fungible ERC-20 tokens for standardized discount units; or custom assets built on specialized voucher protocols. Each token is cryptographically unique and permanently traceable through its on-chain identifier, eliminating the possibility of counterfeiting or unauthorized duplication.

The smart contract governing these tokens encodes all relevant parameters: discount percentages or fixed amounts, validity periods, redemption conditions, transfer restrictions, and any special requirements such as minimum purchase amounts or product category limitations. This programmability allows businesses to create sophisticated promotional structures that automatically enforce business rules without manual intervention.

Distribution Mechanisms: Tokenized voucher codes are distributed through various digital channels—via email campaigns containing wallet addresses or QR codes, social media promotions with airdrop mechanics, direct transfers to users' digital wallets as rewards for specific actions, or through partnerships with decentralized applications and platforms. The distribution process itself can be automated through smart contracts, enabling innovative mechanics such as lottery-based distributions, staking rewards, or achievement-based unlocks.

Customers receive these digital vouchers directly into their cryptocurrency wallets, ensuring secure custody without reliance on centralized databases that could be compromised. The blockchain's permissionless nature means users maintain complete control over their promotional assets, able to view, transfer, or redeem them according to their preferences.

Redemption Process: When customers wish to redeem their blockchain vouchers, they initiate a transaction at checkout by either signing a blockchain transaction that burns or marks the token as used, or by inputting a code derived from their token's cryptographic signature. The merchant's system queries the relevant smart contract to validate the voucher's authenticity, check its unused status, and verify that all redemption conditions are met.

Smart contracts automatically execute the discount application, update the token's status to prevent double-spending, and record the transaction immutably on-chain. This process occurs in seconds, providing instant validation without requiring manual verification or centralized database queries. The cryptographic nature of the system makes fraud virtually impossible, as each redemption requires the legitimate owner's private key signature.

Secondary Market Dynamics: One of the most innovative aspects of blockchain vouchers is their tradability. Some implementations allow peer-to-peer trading or resale of promotional codes through decentralized marketplaces or NFT platforms. Users who cannot use a voucher before expiration can recoup partial value by selling it to interested buyers, while others might purchase discounted vouchers as speculative assets or for personal use.

This secondary market creates liquidity for promotional assets, increases their perceived value, and generates organic marketing effects as users actively seek and trade branded vouchers. Businesses benefit from extended reach and engagement, while customers enjoy flexibility and potential value capture from unused promotions.

Audit Trail and Transparency: Every issuance, transfer, and redemption transaction is permanently recorded on the blockchain, creating an immutable audit trail accessible to all stakeholders. Businesses can query the blockchain to monitor campaign performance in real-time, track voucher velocity, identify popular distribution channels, and detect unusual patterns that might indicate issues or opportunities.

Customers benefit from transparent verification of voucher authenticity and clear visibility into terms and conditions encoded in smart contracts. This transparency builds trust and reduces disputes, as all parties can independently verify the state and history of any voucher token.

Practical Implementation Example

Consider a concrete scenario: Blume 2000 (or any merchant) launches a promotional campaign distributed through a decentralized exchange or DeFi platform, offering blockchain-based voucher codes that unlock percentage discounts for customers purchasing flowers with cryptocurrency. The company mints 10,000 NFT vouchers, each representing a 20% discount on orders above a certain threshold.

Users participating in the campaign receive these vouchers directly into their digital wallets through an airdrop mechanism triggered by completing specific actions—perhaps following social media accounts, referring friends, or making a qualifying purchase. Each voucher is a unique NFT with metadata describing the discount terms, expiration date, and applicable product categories.

When a customer wants to purchase flowers, they connect their wallet to the merchant's website, select products, and choose to apply their voucher NFT at checkout. The smart contract verifies ownership, checks validity, calculates the discount, and marks the NFT as redeemed upon transaction completion. The entire process is transparent, secure, and automated, requiring no manual intervention from customer service representatives.

If a customer cannot use their voucher before expiration, they can list it on an NFT marketplace where other users interested in Blume 2000 products can purchase it at a discounted rate, creating a win-win scenario where the original recipient recovers some value and the new owner gains access to the promotion.

Benefits and Advantages

Enhanced Security and Fraud Prevention

The most compelling advantage of blockchain-based voucher codes is the dramatic reduction in fraud and abuse. Traditional promotional systems suffer from numerous security vulnerabilities: physical coupons can be photocopied indefinitely, digital codes can be leaked through database breaches or shared across coupon websites, and sophisticated attackers can attempt brute-force attacks to guess valid codes.

Blockchain vouchers eliminate these vulnerabilities through cryptographic security. Each token is protected by public-key cryptography, requiring the legitimate owner's private key to authorize any action. The distributed nature of blockchain networks makes tampering virtually impossible, as any attempted fraud would require compromising a majority of network validators simultaneously. Smart contracts enforce redemption rules automatically, preventing double-spending and ensuring each voucher can only be used once according to predefined conditions.

Businesses save significant resources previously spent on fraud detection, dispute resolution, and security infrastructure. The reduction in promotional abuse directly improves campaign ROI and allows companies to offer more generous incentives without fear of exploitation.

Tradability and True Digital Ownership

Traditional promotional codes are inherently restrictive—single-use, non-transferable, and worthless if unused before expiration. Blockchain vouchers fundamentally transform this paradigm by granting users true ownership of their promotional assets. These digital vouchers can be freely transferred to other users, sold on secondary markets, or even used as collateral in decentralized finance applications.

This tradability creates a new digital asset class with intrinsic value beyond the immediate discount. Users who accumulate vouchers through various campaigns can build portfolios of promotional assets, strategically trading or holding them based on personal needs and market dynamics. The ability to recoup value from unused promotions increases customer satisfaction and reduces the psychological cost of missing redemption deadlines.

For businesses, voucher tradability generates powerful viral marketing effects. As users actively seek, trade, and discuss branded vouchers, organic awareness spreads through communities. The secondary market activity provides free advertising and creates sustained engagement long after the initial campaign launch. Some companies have even designed limited-edition voucher NFTs that become collectibles, blending promotional utility with digital art and community building.

Automated Redemption and Efficient Settlement

Smart contracts revolutionize the operational efficiency of promotional campaigns by automating validation and settlement processes. Traditional systems require manual verification steps, customer service interventions for edge cases, and complex backend infrastructure to manage code databases and redemption tracking. These processes are slow, error-prone, and expensive to maintain at scale.

Blockchain vouchers execute automatically according to programmed logic. When a customer attempts redemption, the smart contract instantly verifies all conditions—voucher validity, ownership, expiration status, minimum purchase requirements—and applies the discount without human intervention. Settlement occurs in real-time, with all parties immediately receiving updated balances and records.

This automation dramatically reduces administrative overhead, eliminates processing delays, and removes potential points of human error. Businesses can launch sophisticated multi-tiered promotional structures with complex conditions, confident that smart contracts will enforce rules consistently and accurately. Customer experience improves through instant gratification and seamless integration, while operational costs decrease substantially.

Immutable Transparency and Actionable Data Insights

Every aspect of a blockchain voucher's lifecycle—from initial minting through distribution, transfers, and final redemption—is recorded immutably on the public ledger. This comprehensive transparency provides unprecedented visibility into campaign performance and customer behavior patterns.

Businesses gain access to real-time analytics dashboards showing voucher distribution velocity, secondary market trading patterns, geographic concentration of users, redemption rates across different customer segments, and time-to-redemption metrics. These insights enable data-driven optimization of future campaigns, identification of high-value distribution channels, and understanding of customer preferences and engagement patterns.

The immutable nature of blockchain records provides audit-ready documentation for compliance purposes, financial reporting, and partnership accountability. Disputes become rare as all parties can independently verify transaction histories. Privacy is maintained through pseudonymous addresses while still providing aggregate insights valuable for business intelligence.

Transparency also builds customer trust. Users can verify voucher authenticity before purchase or acceptance, review smart contract code to understand exact terms and conditions, and confirm that businesses are honoring promotional commitments as advertised. This trust foundation strengthens brand relationships and encourages higher engagement rates.

Scalable Global Reach Without Borders

Blockchain voucher systems operate on decentralized networks that function globally, 24/7, without geographic restrictions or operational boundaries. Traditional promotional campaigns often face limitations in international deployment: currency conversion complexities, regional regulatory compliance, distribution infrastructure requirements, and timezone coordination challenges.

Tokenized vouchers transcend these barriers. A business can launch a single campaign that activates simultaneously worldwide, accessible to anyone with a digital wallet regardless of location. Cross-border transactions occur seamlessly without currency conversion fees or international payment processing delays. The permissionless nature of blockchain networks means users in any country can participate equally, democratizing access to promotional opportunities.

This global scalability is particularly valuable for digital-native businesses, e-commerce platforms, and companies seeking to expand internationally without establishing physical presence. Marketing campaigns can achieve viral global spread organically through community sharing and secondary market trading, reaching audiences that traditional advertising channels might never access cost-effectively.

Programmability and Creative Customization

Smart contracts enable unprecedented programmability in promotional mechanics, allowing businesses to design sophisticated incentive structures that adapt dynamically to user behavior and market conditions. Traditional vouchers are static—a fixed discount with simple expiration logic. Blockchain vouchers can incorporate complex conditional logic, multi-stage unlocks, and interactive elements.

Examples of programmable voucher features include:

- Time-based vesting: Vouchers that increase in value over time, rewarding patient customers and creating anticipation

- Achievement-based unlocks: Discounts that activate after users complete specific actions—social media shares, friend referrals, product reviews, or participation in brand events

- Loyalty milestones: Vouchers that combine or upgrade when customers accumulate multiple tokens, incentivizing repeat engagement

- Conditional discounts: Promotions that adjust based on external data feeds—weather conditions, stock levels, or cryptocurrency prices

- Gamified mechanics: Vouchers that incorporate random elements, collectible series, or combination bonuses that encourage strategic accumulation

This programmability transforms vouchers from simple discount instruments into engaging interactive experiences that build sustained customer relationships. Businesses can experiment with novel promotional strategies, A/B test different mechanics through smart contract parameters, and continuously optimize based on performance data.

Conclusion and Future Outlook

The emergence of concepts like 'blume 2000 gutscheincode' represents a profound convergence of retail innovation, blockchain technology, and decentralized finance principles—one where traditional promotional incentives are fundamentally elevated through transparency, cryptographic security, and user empowerment. This transformation extends far beyond technical novelty; it reimagines the foundational relationship between businesses and customers in the digital economy.

Businesses that strategically harness this technological fusion position themselves at the forefront of customer engagement innovation. By treating promotional assets as valuable digital properties rather than disposable marketing materials, companies can forge deeper emotional connections with their audiences, unlock entirely new revenue channels through secondary market dynamics, and gather unprecedented behavioral insights that inform product development and strategic planning.

The broader implications for the retail and e-commerce sectors are substantial. As blockchain infrastructure matures and user adoption of digital wallets accelerates, tokenized promotions are likely to become standard practice rather than experimental initiatives. The barriers to entry continue to decrease as turnkey blockchain voucher platforms emerge, allowing even small businesses to leverage sophisticated promotional mechanics previously accessible only to large enterprises with extensive technical resources.

Looking ahead, we can anticipate several evolutionary trends in blockchain-based promotional systems:

Integration with Metaverse and Virtual Worlds: As virtual reality environments and metaverse platforms gain mainstream adoption, blockchain vouchers will extend into digital spaces, offering discounts on virtual goods, access to exclusive digital events, or hybrid promotions that bridge physical and virtual commerce.

Cross-Brand Collaboration Networks: Interoperable voucher standards will enable collaborative promotional ecosystems where multiple businesses participate in shared loyalty programs, allowing customers to accumulate and redeem value across diverse brands and platforms seamlessly.

Artificial Intelligence Optimization: Machine learning algorithms will analyze blockchain voucher data to automatically optimize promotional strategies, predict redemption patterns, and personalize offers for individual users based on on-chain behavior histories.

Regulatory Framework Development: As tokenized promotions become widespread, regulatory bodies will establish clearer frameworks governing their issuance, taxation, and consumer protection requirements, providing legal certainty that accelerates institutional adoption.

Environmental and Social Impact Integration: Blockchain vouchers will increasingly incorporate sustainability metrics and social responsibility elements—rewarding eco-friendly purchasing decisions, supporting charitable causes through redemption mechanisms, or incentivizing verified sustainable practices.

The flowers of innovation are truly blooming in this intersection of traditional commerce and decentralized technology. As the digital economy continues its inexorable evolution, blockchain-enabled promotional systems like those conceptualized under the 'blume 2000 gutscheincode' framework will play an increasingly central role in shaping how value, loyalty, and customer engagement are imagined and implemented. Businesses that embrace this transformation early will cultivate competitive advantages that compound over time, while those that delay risk obsolescence in an increasingly tokenized commercial landscape.

The future of promotional marketing is programmable, transparent, and user-centric—built on blockchain foundations that empower both businesses and customers with unprecedented capabilities. This represents not merely an incremental improvement over existing systems, but a fundamental reimagining of how economic incentives function in the digital age.

FAQ

What is the Blume 2000 crypto finance voucher code?

Blume 2000 voucher code is a promotional offer for crypto finance services, providing discounts or rewards on transactions. Users can apply this code during registration or checkout to unlock special benefits, enhanced trading rates, or bonus credits in their crypto finance accounts.

How to obtain and use Blume 2000 Crypto Finance coupon codes?

Visit the official Blume 2000 platform, navigate to the promotions section, and claim available coupon codes. Enter your code at checkout to receive instant discounts on crypto transactions. Codes typically offer percentage-based or fixed-amount reductions on trading fees or purchases.

What are the usage restrictions and validity period for Blume 2000 crypto finance voucher codes?

Blume 2000 voucher codes typically have a validity period of 30-90 days from issuance. Usage restrictions include minimum transaction amount requirements, single-use per account, and eligibility limited to new users. Codes cannot be combined with other promotions and may have specific trading amount thresholds.

What security precautions should I take when using Blume 2000 crypto finance voucher codes?

Verify codes only from official sources, avoid phishing links, never share private keys or passwords, use secure wallets, enable two-factor authentication, and confirm code validity before redeeming to protect your crypto assets.

How much discount or benefits does Blume 2000's cryptocurrency finance coupon code provide?

Blume 2000 typically offers promotional coupon codes providing discounts ranging from 10% to 30% on trading fees or deposit bonuses. Specific benefits vary by campaign and may include reduced transaction costs, cashback rewards, or welcome bonuses for new users in crypto finance services.

What should I do if the Blume 2000 voucher code is not working?

Check code expiration date, verify correct entry without extra spaces, ensure minimum transaction amount met, confirm account eligibility requirements satisfied. Contact customer support if issues persist for code verification assistance.

# What are the Top Crypto Security Risks: Smart Contract Vulnerabilities, Network Attacks, and Exchange Custody Threats in 2025?

What are the security risks and vulnerabilities in NXPC smart contracts and cryptocurrency exchanges?

What Is Sui Network's Core Value Proposition in the 2025 Blockchain Landscape?

Monthly Active User Statistics for a Leading Web3 Wallet

How Active is Sui's Community and Ecosystem in 2025?

How Does Cronos (CRO) Measure Community Engagement and Ecosystem Growth in 2025?

What is the current crypto market overview: top market caps, trading volumes, and liquidity rankings 2026

What is the impact of regulatory compliance and SEC oversight on cryptocurrency market adoption in 2026?

What is crypto holdings and fund flows: how to analyze exchange inflows, staking rates, and institutional positions?

What is the difference between top cryptocurrency competitors: market cap, performance, and user adoption in 2026

How to Measure Crypto Community Engagement: Twitter Followers, Telegram Activity, and Developer Contributions