Genesis Block

The genesis block is the first ever block recorded on its respective blockchain network, also occasionally referred to as Block 0 or Block 1. This foundational block marks the beginning of a blockchain's existence and serves as the anchor point for all subsequent blocks in the chain.

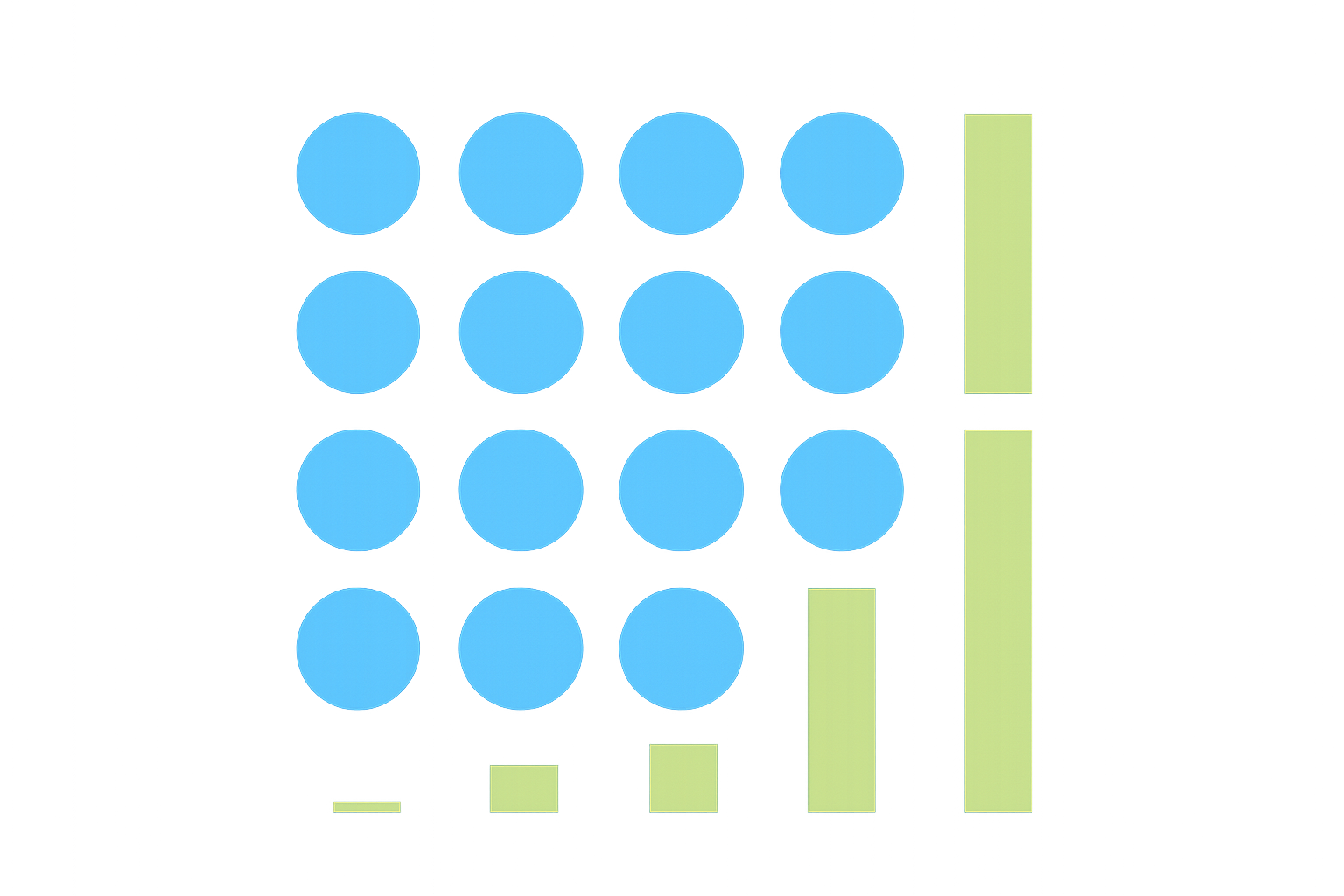

When a block is broadcasted to the blockchain, it references the previous block through a cryptographic hash, creating an unbreakable chain of blocks. However, in the case of the genesis block, there is no previous block to reference, making it unique in the blockchain's architecture.

Because there is no previous block to reference, genesis blocks are generally hardcoded into the software by the blockchain's developers. This hardcoding ensures that every node in the network starts with the same initial state, establishing consensus from the very beginning.

In terms of Bitcoin, the genesis block was created on January 3rd, 2009, marking the birth of the world's first cryptocurrency. This block had a reward of 50 BTC that is forever unspendable, a characteristic that distinguishes it from all other blocks in the Bitcoin blockchain. It remains unknown whether the genesis block's reward was intentionally made unspendable, as there was no explicit explanation regarding this design choice from Satoshi Nakamoto, Bitcoin's pseudonymous creator.

Bitcoin Genesis Block

The hash of the Bitcoin genesis block (000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f) is unique and historically significant. It contains two additional leading hex zeros than required by other early blocks, demonstrating the proof-of-work difficulty that was set at Bitcoin's inception.

The 50 BTC reward from the genesis block was sent to the address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa. Over the years, this address has accumulated over 66 BTC through voluntary contributions from the Bitcoin community, with hundreds of transactions sent to it as a form of tribute or symbolic gesture. The original block reward of 50 BTC will remain unspendable forever due to the way the genesis block was coded, and people who have sent their Bitcoin to this address should understand that those funds cannot be retrieved.

This technical peculiarity of the genesis block has sparked numerous discussions within the cryptocurrency community about whether it was an intentional design choice or an oversight. Regardless of the intention, it has become a defining characteristic of Bitcoin's genesis block and adds to its mystique and historical significance.

The Hidden Message

Within the Bitcoin genesis block, a message was deliberately left by Satoshi Nakamoto, forever written in the blockchain's history. Within the coinbase parameter, along with the regular block data, the following message was included, which was a headline from The Times newspaper:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

This message serves multiple purposes and has been the subject of extensive analysis. It was likely included as a timestamp to prove that the block was not created before January 3rd, 2009, providing verifiable evidence of when Bitcoin's blockchain began. The use of a newspaper headline is a cryptographic proof technique that demonstrates the block could not have been pre-mined or created earlier.

However, the chosen headline also carries profound symbolic meaning and has strong relevance to the reason Bitcoin was created in the first place. The reference to bank bailouts during the 2008 financial crisis reflects the philosophical motivation behind Bitcoin's creation: to provide an alternative to the traditional financial system and central bank monetary policies. This message has become an iconic part of Bitcoin's origin story, representing the cryptocurrency's founding principles of decentralization and financial sovereignty.

Timestamps

After the genesis block of Bitcoin, an interesting temporal anomaly occurred. The next block on the blockchain had a timestamp recorded six days later, creating an unusual gap in the early blockchain history:

- Block 0: 2009-01-03 18:15:05

- Block 1: 2009-01-09 02:54:25

The exact reason behind this six-day gap remains unknown and has been the subject of speculation within the cryptocurrency community. Several theories have been proposed to explain this phenomenon. One hypothesis suggests that Satoshi Nakamoto took a deliberate break after creating the genesis block, possibly to test the network or reflect on the launch. Another intriguing theory proposes that this timing was intentionally planned to correlate with the biblical account of the world being created in six days, adding symbolic significance to Bitcoin's creation narrative.

Alternatively, some researchers believe that Satoshi may have been mining privately during this period to ensure the network's stability before making it publicly available. Regardless of the true reason, this six-day gap has become another mysterious element of Bitcoin's origin story, contributing to the legend surrounding its creation and its enigmatic founder.

FAQ

What is Genesis Block (Creation Block)?

Genesis Block is the first block in a blockchain network, containing the initial cryptocurrency supply and establishing the foundation for all subsequent blocks and transactions within the network.

What is the difference between Genesis Block and ordinary blocks?

Genesis Block is the first block in a blockchain, created at network launch with no predecessor. Ordinary blocks are subsequent blocks linked chronologically, each referencing the previous block's hash. Genesis Block initializes the chain and establishes foundational parameters, while ordinary blocks record transactions and maintain network continuity.

When was Bitcoin's Genesis Block created?

Bitcoin's Genesis Block was created on January 3, 2009. It is the first block in the Bitcoin blockchain, generated by Satoshi Nakamoto, marking the official launch of the Bitcoin network.

What information is contained in the Genesis Block?

The Genesis Block contains the initial block data including the timestamp of creation, the first transactions, a coinbase reward, the merkle root hash, difficulty target, and nonce. It serves as the foundation of the blockchain network.

Do all different blockchain projects have a Genesis Block?

Yes, every blockchain has a Genesis Block. It's the first block in the chain, created at launch. Each project initializes its own Genesis Block with specific parameters, making it fundamental to blockchain architecture and network initialization.

What is special about the hash value of the Genesis Block?

The Genesis Block's hash is historically significant as the first block in a blockchain network. It serves as the foundation for all subsequent blocks, and its hash is hardcoded into the protocol. This immutable hash represents the blockchain's origin and validates the entire chain's integrity and legitimacy from inception.

Guide to Setting Up Your Own Cryptocurrency Mining Pool

Understanding Bitcoin Mining Pools: A Comprehensive Guide

Understanding Cryptocurrency Mining Pools: A Beginner's Guide

Understanding Satoshi to Bitcoin Conversion: A Quick Guide

Join a Crypto Mining Pool: A Comprehensive Guide

Understanding the Role of a Nonce in Cryptocurrency

Moving Average Ribbon

How to Margin Trade Crypto: A Comprehensive Guide

What Is Open Interest?

Pi Coin Price Prediction 2050: What to Expect

Analysis of Reasons Behind Solana's Price Decline