What is crypto holdings and fund flows: how to analyze exchange inflows, staking rates, and institutional positions?

Exchange inflows and outflows: tracking capital movements across major trading platforms

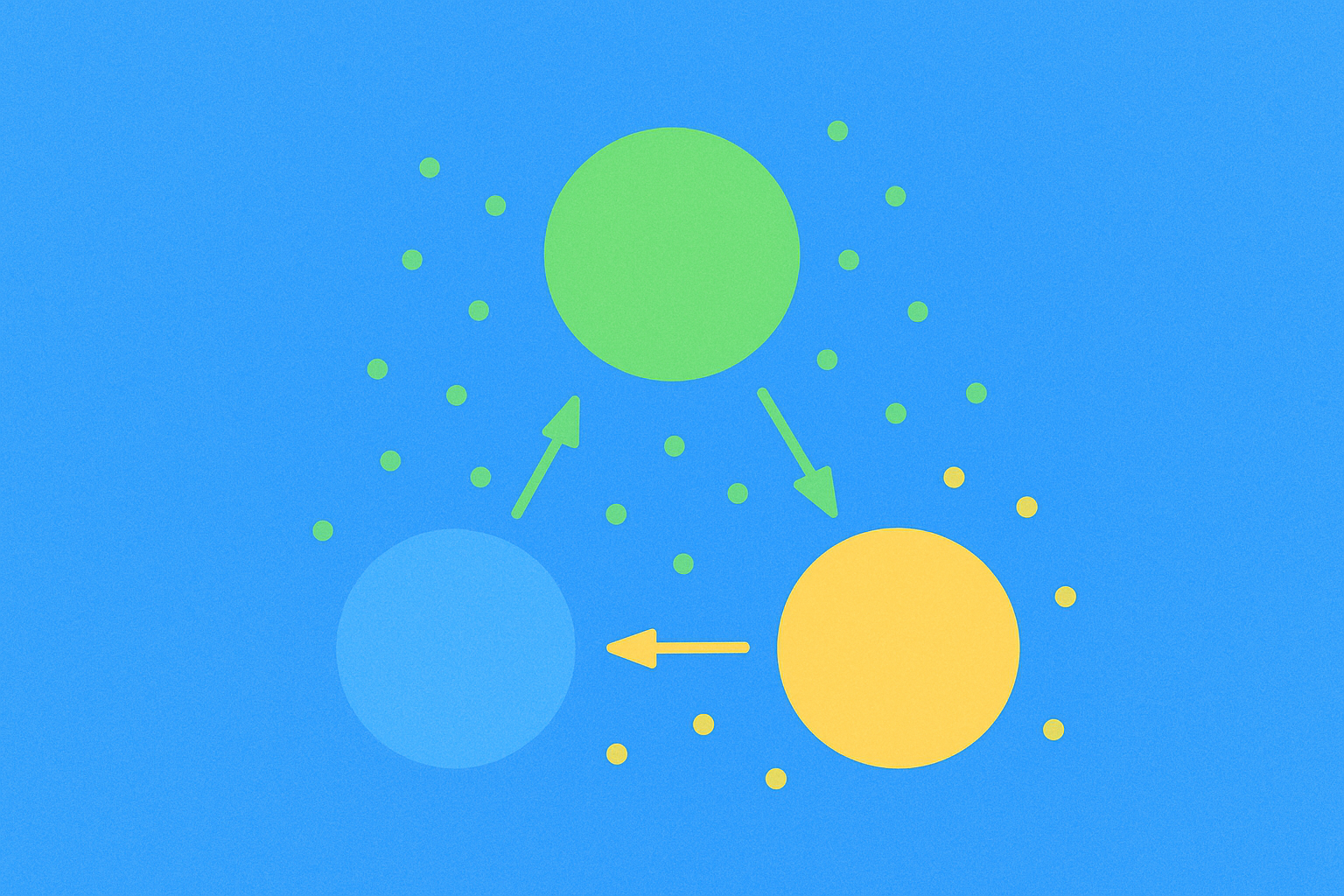

Monitoring exchange inflows and outflows represents one of the most critical indicators for understanding market dynamics and capital movements across major trading platforms. When significant quantities of assets flow into exchanges, this typically signals potential selling pressure, as investors prepare to liquidate positions. Conversely, exchange outflows often indicate accumulation behavior, where participants withdraw assets to cold storage or long-term holdings, reducing immediate supply available for trading.

The relationship between these capital movements and price action provides valuable insights into market sentiment. Large exchange inflows concentrated within short timeframes frequently precede price declines, as the influx of selling pressure impacts market equilibrium. For instance, stablecoins like USDT, which consistently maintain exceptional trading activity across multiple platforms with over $110 billion in daily volume, serve as reliable indicators of capital reallocation patterns. When USDT flows spike into major exchanges, it typically precedes significant market movements as traders prepare to deploy capital.

Analyzing exchange inflows and outflows requires attention to both magnitude and velocity. Gradual capital movements may reflect routine portfolio rebalancing, while sudden surges suggest urgent repositioning. On-chain data providers now track these flows across gate and dozens of other platforms in real-time, enabling traders to identify emerging trends before broader market recognition.

Institutional investors particularly leverage exchange flow analysis to optimize entry and exit timing. By correlating inflow data with other metrics like moving averages and volume patterns, sophisticated market participants gain competitive advantages in timing their transactions. Understanding these capital movement patterns thus becomes essential for anyone seeking to enhance their analytical framework and anticipate directional shifts in cryptocurrency markets.

Holding concentration and staking rates: measuring market risk through asset distribution

Understanding asset concentration patterns provides critical insight into potential market vulnerabilities. When a significant portion of a cryptocurrency's supply concentrates in few wallets or staking contracts, it amplifies market risk and influences price stability. Staking rates represent another essential metric, as they indicate what percentage of circulating supply is locked in yield-generating activities, directly affecting available liquidity and short-term trading dynamics.

Holding concentration becomes especially pronounced with major stablecoins like USDT, which maintains over 187 billion tokens in active circulation across 50+ blockchain networks. This distributed yet concentrated structure creates complex market dynamics—while multi-chain presence enhances accessibility, it also fragments liquidity and creates potential flash points if large institutional positions exit simultaneously. Examining staking rates alongside exchange inflows reveals trader sentiment and capital allocation patterns; high staking rates typically indicate bullish sentiment and reduced selling pressure, whereas declining rates may signal institutional repositioning.

Asset distribution analysis examines how holdings spread across exchange wallets, institutional vaults, and decentralized protocols. When distribution becomes highly skewed toward centralized exchanges or specific institutional players, market risk intensifies—sudden liquidations or large transfers could trigger cascading price movements. Professional investors monitoring these metrics track concentration thresholds and staking participation rates as early warning signals, recognizing that balanced asset distribution correlates with healthier, more resilient markets compared to scenarios exhibiting severe concentration patterns.

Institutional positioning dynamics: analyzing large holder behavior and on-chain lock-ups

Monitoring large holder behavior provides critical insights into institutional sentiment and positioning strategies within cryptocurrency markets. When major stakeholders accumulate or distribute assets, their transactions often precede significant market movements, making them valuable indicators for analyzing broader fund flows. On-chain lock-ups, where institutional investors commit assets to smart contracts or staking protocols, demonstrate genuine long-term positioning rather than speculative trading.

The concentration of holdings among large players reveals market structure and potential pressure points. High institutional positioning in specific assets can amplify price volatility during liquidation events or reallocation cycles. By tracking on-chain lock-ups across different protocols and time horizons, analysts can distinguish between temporary holdings and committed capital. These metrics become particularly meaningful when examining staking arrangements, where institutional lock-ups often signal confidence in blockchain ecosystems.

Analyzing exchange inflows alongside large holder positions creates a comprehensive picture of institutional activity. When major holders move assets to exchanges, it typically suggests preparation for exit or rebalancing. Conversely, withdrawals indicate accumulation phases and strengthening positions. Understanding these dynamics through on-chain data enables investors to anticipate institutional fund flows and positioning adjustments before they manifest in price discovery.

FAQ

What are crypto exchange inflows and outflows? How to judge market sentiment through these indicators?

Exchange inflows occur when users deposit crypto into exchanges, often indicating selling pressure. Outflows suggest users withdrawing assets, typically signaling bullish sentiment. High inflows may predict price declines, while sustained outflows often precede rallies. Monitoring these flows reveals institutional and retail positioning, helping assess whether markets will rise or fall.

How to analyze institutional investor position changes to predict cryptocurrency market trends?

Monitor on-chain data like whale wallet movements, large fund transactions, and staking rates. Track institutional net inflows and outflows patterns. Analyze position concentration changes and derivative positions. Rising institutional accumulation typically signals bullish sentiment, while large liquidations may indicate downward pressure ahead.

What impact does rising or falling staking rates have on cryptocurrency prices?

Rising staking rates typically increase token lock-up, reducing circulating supply and potentially supporting prices. Falling rates may trigger unstaking, increasing selling pressure and downward price movement. Higher staking rewards attract more participants, creating bullish sentiment, while declining rewards can shift investors toward other opportunities.

What tools and platforms can track on-chain cryptocurrency fund flows in real-time?

Popular on-chain analysis tools include Glassnode, Nansen, CryptoQuant, and Blockchain.com. These platforms monitor wallet transfers, exchange inflows/outflows, staking activities, and institutional positions through blockchain data, providing real-time insights into crypto market movements and fund flows.

What does large fund outflow from exchange wallet addresses mean? Is it a bullish or bearish signal?

Large outflows typically indicate whales or institutions withdrawing coins to cold storage or personal wallets, suggesting confidence in long-term holding. This is generally a bullish signal, as it reduces selling pressure on exchanges and demonstrates conviction in price appreciation.

How to distinguish behavioral characteristics of whale holdings, institutional holdings, and retail holdings?

Whales show large transaction amounts and irregular timing; institutions display consistent, strategic accumulation with long-term patterns; retail investors make frequent small trades with high volatility. Analyze transaction volumes, holding duration, and position concentration to differentiate these market participants.

What does an increase or decrease in the number of long-term cryptocurrency holders (HODLers) indicate?

An increase in HODlers signals strong market confidence and reduced selling pressure, suggesting bullish sentiment and potential price stability. A decrease indicates weakening conviction, potentially preceding downturns. Rising HODler counts typically correlate with accumulation phases and long-term value recognition.

How Does Crypto Competitor Analysis Drive Market Share Changes?

Exploring Token Unlock Mechanisms and Their Effect on Crypto Value in 2025

Exploring Liquidity Pools in DeFi: A Comprehensive Guide

Unleashing Efficiency: Exploring Decentralized Trading Protocols with Automated Market Makers

Understanding Automated Market Makers in the Crypto World

Maximize Your Returns with Stablecoin Interest Rates

Advantages and Disadvantages of the Martingale System in Trading

What Is the Otherside Metaverse?

What Cryptocurrency Does Elon Musk Own

Telegram Crypto Mining Bots List and Guide

What is M Pattern in Trading