Blockchain Innovation: Exploring Mainchain and Sidechain Technologies

What Is Layer-0: Redefining Blockchains with Mainchains and Sidechains

The blockchain ecosystem is intricate, built on multiple layers of technology that power its transformative capabilities. While terms like layer-1 and layer-2 are now commonplace, a new category has entered the spotlight: layer-0. This blockchain protocol forms the foundational infrastructure for many of the digital assets and tokens traded today.

Blockchain Overview

Before exploring layer-0, it's important to understand the fundamentals of blockchain technology. At its core, a blockchain is a public, distributed digital ledger that records transactions securely using cryptography. The blockchain stack typically consists of five layers: hardware infrastructure, data, network, consensus, and application.

Understanding Blockchain Protocols

When learning about blockchain, you'll encounter terms like layer-1 and layer-2, which classify different types of blockchain protocols with distinct roles in the overall ecosystem. Layer-0 is gaining traction for its emphasis on scalability and interoperability across blockchains.

How Does Layer-0 Work?

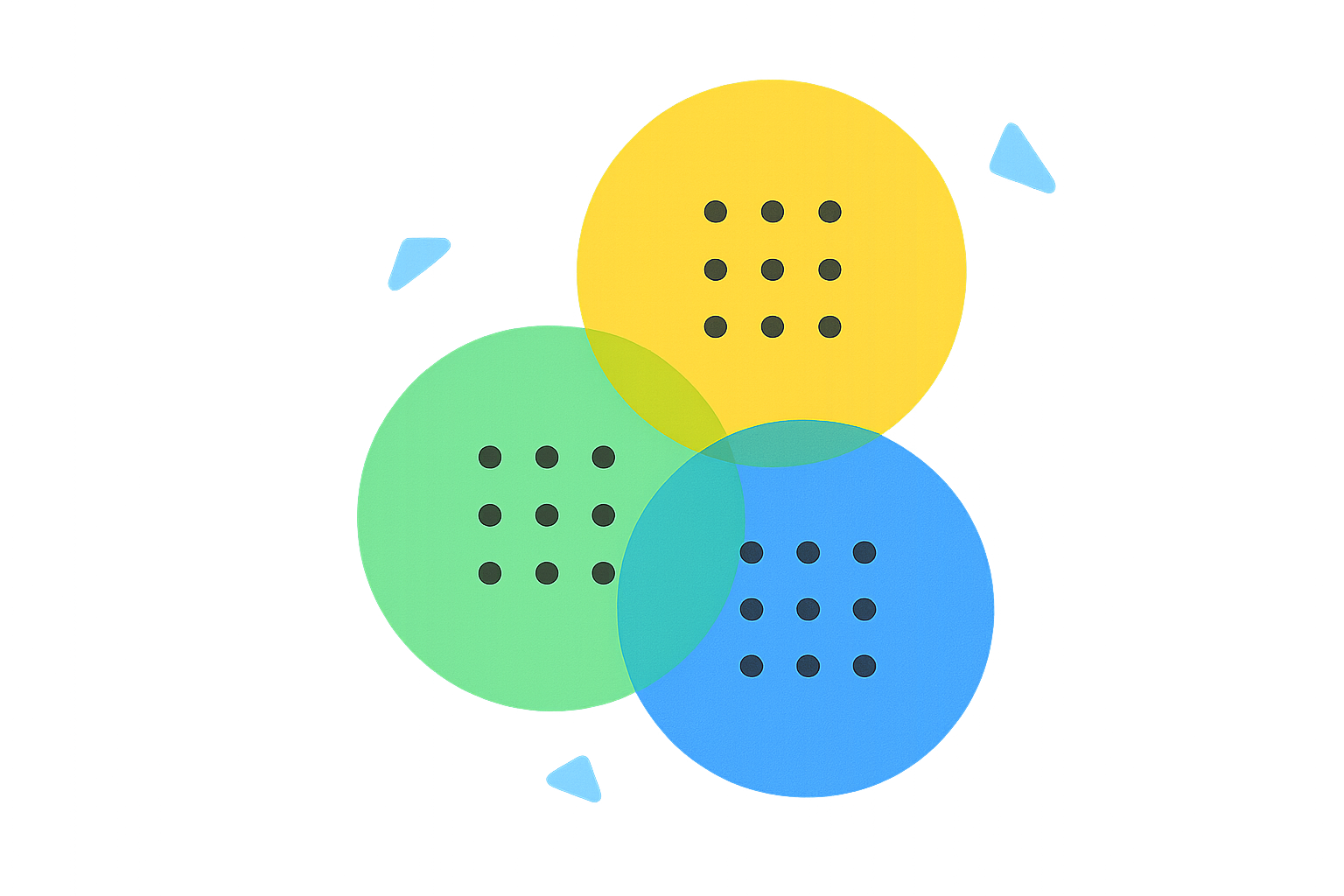

Layer-0 blockchain protocols use a sidechain-based architecture, comprised of three elements:

- The mainchain, which facilitates data transfer between multiple layer-1s built on layer-0.

- Sidechains—application-specific layer-1s connected to the mainchain.

- An interchain communication protocol that standardizes data exchange among layer-1s.

Advantages of Layer-0 Blockchain Protocols

- Scalability: By distributing transactions across various layers, layer-0 increases network efficiency and supports higher throughput without compromising security.

- Customization: Developers can create specialized layer-1 chains tailored to distinct use cases.

- Innovation: Layer-0’s modular design accelerates development and experimentation, fueling new functionalities and applications within the blockchain sector.

Layer-0 vs. Layer-1: Key Differences

Layer-0 and layer-1 both deliver core benefits such as decentralization, security, and transparency, but they diverge in several critical areas:

- Primary Function: Layer-0 provides the foundational infrastructure for building blockchains, while layer-1 manages transaction processing and consensus protocols directly.

- Scalability: Layer-0 enhances scalability by fostering interoperability among various layer-1 blockchains.

- Flexibility: Layer-0’s flexible architecture enables the creation of diverse layer-1 blockchains with unique features.

Leading Layer-0 Examples

Notable layer-0 protocols include:

- Avalanche (AVAX)

- Cosmos (ATOM)

- Polkadot (DOT)

Each protocol presents distinct models for blockchain interoperability and scalability.

Conclusion

The success of layer-0 protocols such as Cosmos, Polkadot, and Avalanche marks a significant evolution in blockchain architecture. By addressing the scalability and interoperability limitations found in leading layer-1 blockchains, layer-0 protocols act as the core infrastructure, enabling modular sidechains and specialized communication standards. This unlocks a more dynamic, interconnected blockchain ecosystem, where customizable layer-1s built atop robust layer-0 foundations serve specific market needs and pave the way for a future defined by seamless blockchain integration.

FAQ

Which Cryptocurrencies Are Layer-0?

Polkadot (DOT), Cosmos (ATOM), and Avalanche (AVAX) are prominent layer-0 cryptocurrencies providing infrastructure for interoperable blockchains.

Is Bitcoin a Layer-0 or Layer-1 Blockchain?

Bitcoin is classified as a layer-1 blockchain. It is the primary blockchain that directly processes and validates transactions on its main network.

What Is Layer-Zero Crypto?

Layer-zero crypto refers to blockchain infrastructure that securely connects multiple networks, enabling efficient communication and asset transfers across different chains.

What Is the Difference Between Layer-1, Layer-2, and Layer-0?

Layer-0 is the foundational infrastructure, Layer-1 represents the primary blockchain, and Layer-2 encompasses scalability solutions built on top of Layer-1.

Understanding Layer 0 in Blockchain Technology

Innovative Blockchain Solutions: Enhancing Scalability with Main and Side Chains

Fundamentals of Blockchain Architecture: Layer 0

Blockchain Layer 0 Fundamentals: Everything You Should Know

Exploring the Foundation of Blockchain Technology: Understanding Layer 0

Clayton Listing Details: Launch Date, Price Predictions, and How to Buy CLAY

How to Use MACD, RSI, and Bollinger Bands to Predict Crypto Price Movements

What are the biggest cryptocurrency security risks and exchange hacks in crypto history

What causes crypto price volatility and how do support and resistance levels predict future price movements

What Metrics Determine Crypto Community and Ecosystem Activity in 2026