What Are the Major Smart Contract Vulnerabilities and Security Risks in Crypto Exchanges Like SHIB?

Smart Contract Vulnerabilities in SHIB Ecosystem: From $60 Million Staking Platform Breach to $19 Million Cross-Chain Bridge Exploit

Shibarium's cross-chain infrastructure suffered a critical vulnerability exploitation in September 2025 when attackers executed a sophisticated flash loan attack targeting the network's bridge protocol. The incident revealed severe weaknesses in the validator key management system, where the attacker successfully borrowed 4.6 million BONE tokens and subsequently gained control of 10 out of 12 validator signing keys that secure the network.

| Aspect | Details |

|---|---|

| Attack Method | Flash loan exploitation |

| Validator Keys Compromised | 10 out of 12 keys |

| Token Borrowed | 4.6 million BONE |

| Funds Drained | ETH and SHIB tokens |

| Response Time | Pause functions, secure multisig wallet |

The vulnerability highlighted critical gaps in Shibarium's smart contract architecture, particularly in how validator authentication mechanisms protect against flash loan attacks. The technical flaw allowed attackers to temporarily inflate their voting power through uncollateralized token borrowing, bypassing the intended security checks designed to prevent unauthorized validator access. This breach exposed a fundamental weakness in cross-chain bridge implementations, demonstrating that insufficient cryptographic protections and inadequate time-lock mechanisms in validator key transfer processes create exploitable attack vectors. The Shiba Inu development team immediately suspended bridge operations and engaged security forensics firms to investigate the compromise.

Network Attack Vectors Against Crypto Exchanges: Exchange Hacks, Flash Loan Exploits, and Validator Key Compromise

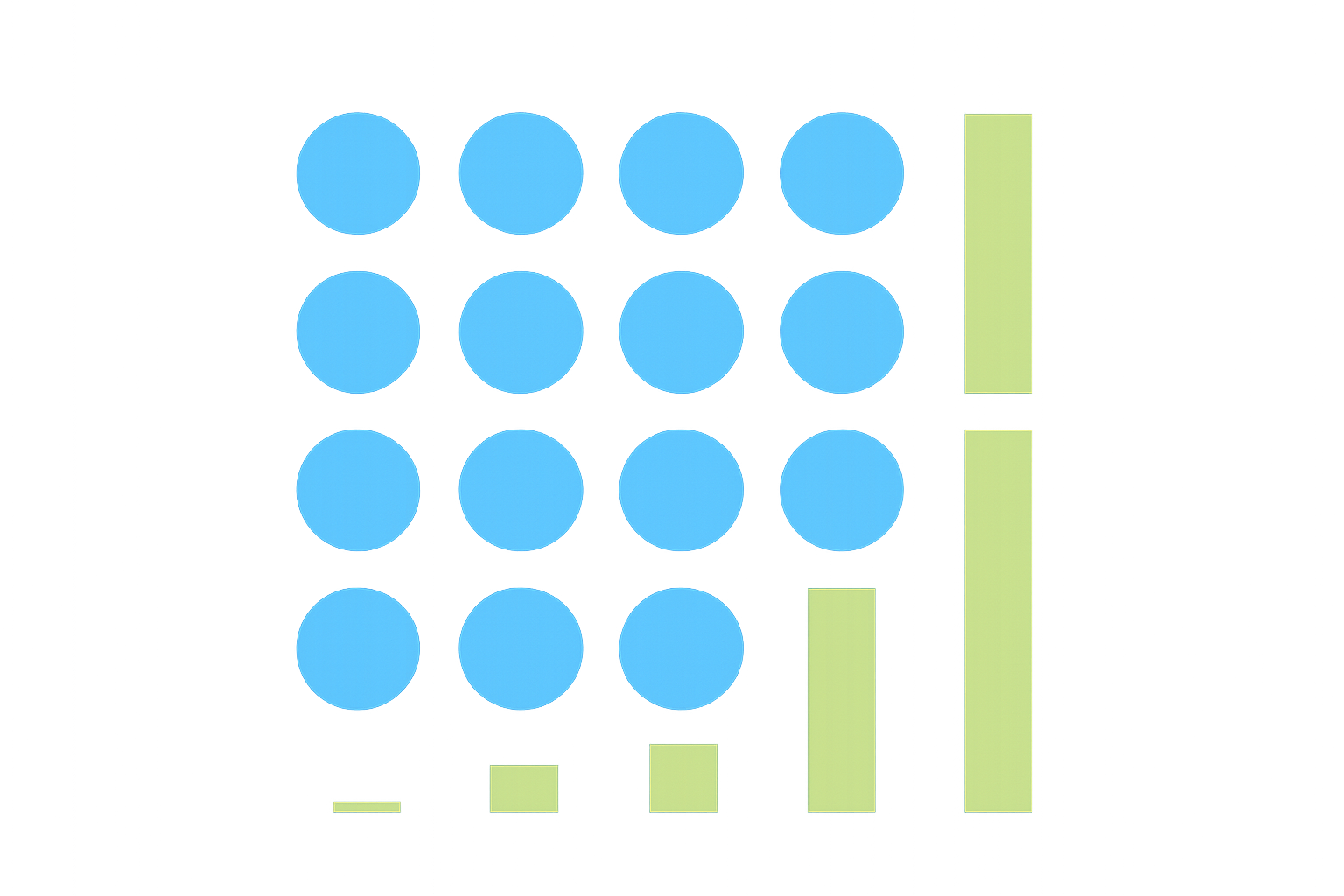

Cryptocurrency exchanges face multifaceted security threats that have evolved significantly with the maturation of blockchain technology. Exchange hacks represent the most direct threat, where attackers compromise platform infrastructure to extract digital assets. A notable incident in 2025 resulted in a $4 million loss affecting 17 different coins, including $1 million in Ethereum and $1.3 million in SHIB tokens, demonstrating the scale of potential damage when exchange security fails.

Flash loan exploits present a more sophisticated attack vector specific to decentralized finance protocols. These attacks leverage borrowed funds to manipulate token prices within a single blockchain transaction, exploiting pricing vulnerabilities before repaying the loan. Shibarium experienced a $2.4 million loss through such an attack, where sophisticated threat actors manipulated prices on decentralized exchanges to execute arbitrage trades at artificially distorted prices, draining protocol liquidity pools rapidly.

Validator key compromise poses an existential threat to blockchain networks themselves. When attackers compromise validator signing keys, they gain majority control over network operations, enabling them to sign false blockchain versions and drain assets directly from network bridges. The Shibarium bridge hack resulted in a $4.1M theft through this mechanism, compelling network operators to pause operations and implement substantial security upgrades.

These attack vectors collectively demonstrate that exchange security extends beyond traditional cybersecurity measures. Platforms must implement robust API key protection, real-time monitoring systems, and decentralized consensus mechanisms to withstand these sophisticated threats. The convergence of exchange hacks, flash loan exploits, and validator key compromises indicates that comprehensive, multi-layered security strategies are essential for protecting user assets.

Centralized Exchange Custodial Risks: BigONE's $27 Million Loss and WazirX's $235 Million Security Breach Impact on SHIB Holdings

Cryptocurrency exchanges face significant custodial risks that directly threaten asset holders. Recent major incidents demonstrate this vulnerability with alarming clarity. In 2025, BigONE suffered a supply chain attack resulting in a $27 million loss after hackers compromised the production network and disabled security checks. Similarly, WazirX experienced a catastrophic breach in 2021 with losses exceeding $235 million.

| Exchange | Loss Amount | Attack Type | SHIB Impact | Year |

|---|---|---|---|---|

| BigONE | $27 million | Supply chain attack | User balances protected | 2025 |

| WazirX | $235 million | Wallet compromise | Withdrawal halts | 2021 |

SHIB holders faced particularly acute risks through WazirX, which held significant quantities of the token. The compromised wallet contained substantial SHIB amounts alongside ETH and MATIC. While BigONE pledged to cover all losses using internal reserves, the underlying vulnerability persisted—users lost control over their assets precisely when protection mattered most. Industry data reveals $1.71 billion lost across 344 wallet breaches in the first half of 2025 alone. This pattern underscores a critical reality: centralized exchanges represent points of concentration where security failures cascade into user losses. Self-custody solutions emerge as the essential alternative for protecting SHIB holdings against institutional vulnerabilities.

FAQ

Will SHIB ever hit $1?

While unlikely in the near term due to SHIB's massive circulating supply, significant market catalysts and sustained adoption could theoretically enable price appreciation. However, reaching $1 would require extraordinary market conditions and fundamental shifts in the ecosystem.

How high will Shiba Inu go in 2025?

Based on market analysis, Shiba Inu (SHIB) is predicted to reach approximately $0.000036 by end of 2025. This projection reflects current market trends and ecosystem development momentum throughout the year.

Is the SHIB coin worth?

Yes, SHIB coin is worth considering. With a market cap of $4.4 billion and active community support, it demonstrates solid market presence. Current price at $0.00000757 offers accessibility for investors seeking exposure to the meme coin ecosystem.

Will Shiba hit $1 in 2040?

Reaching $1 by 2040 is highly unlikely given current market conditions and tokenomics. While SHIB could experience growth through increased adoption and token burns, the price target remains unrealistic without extraordinary market changes.

Top Secure Wallets for Avalanche (AVAX)

Understanding Custodial and Non-Custodial Wallets: Key Differences Explained

Ultimate Guide to Secure Crypto Storage with MPC Wallets

What are cryptocurrency smart contract vulnerabilities and security risks in 2026?

Understanding Decentralized Finance Wallet Solutions

Understanding Flash Loan Attacks in Decentralized Finance: A Comprehensive Guide

Moving Average Ribbon

How to Margin Trade Crypto: A Comprehensive Guide

What Is Open Interest?

Pi Coin Price Prediction 2050: What to Expect

Analysis of Reasons Behind Solana's Price Decline