Mastering the Fundamentals of Directed Acyclic Graphs

What Is a Directed Acyclic Graph (DAG) Ledger?

The Directed Acyclic Graph (DAG) ledger is an innovative technology in the cryptocurrency industry, providing a compelling alternative to traditional distributed ledger systems. This article examines the concept of DAG, its operational mechanics, and its relevance in digital asset ecosystems.

Summary

DAG technology offers several notable advantages:

- Superior speed and scalability compared to conventional distributed ledgers.

- Removes the need for block creation and mining.

- Structures transactions as interconnected nodes for enhanced efficiency.

- Substantially lowers energy consumption.

- Minimal or zero transaction fees.

Despite these benefits, DAG does not aim to fully replace traditional distributed ledgers and faces unique challenges, including issues related to centralization.

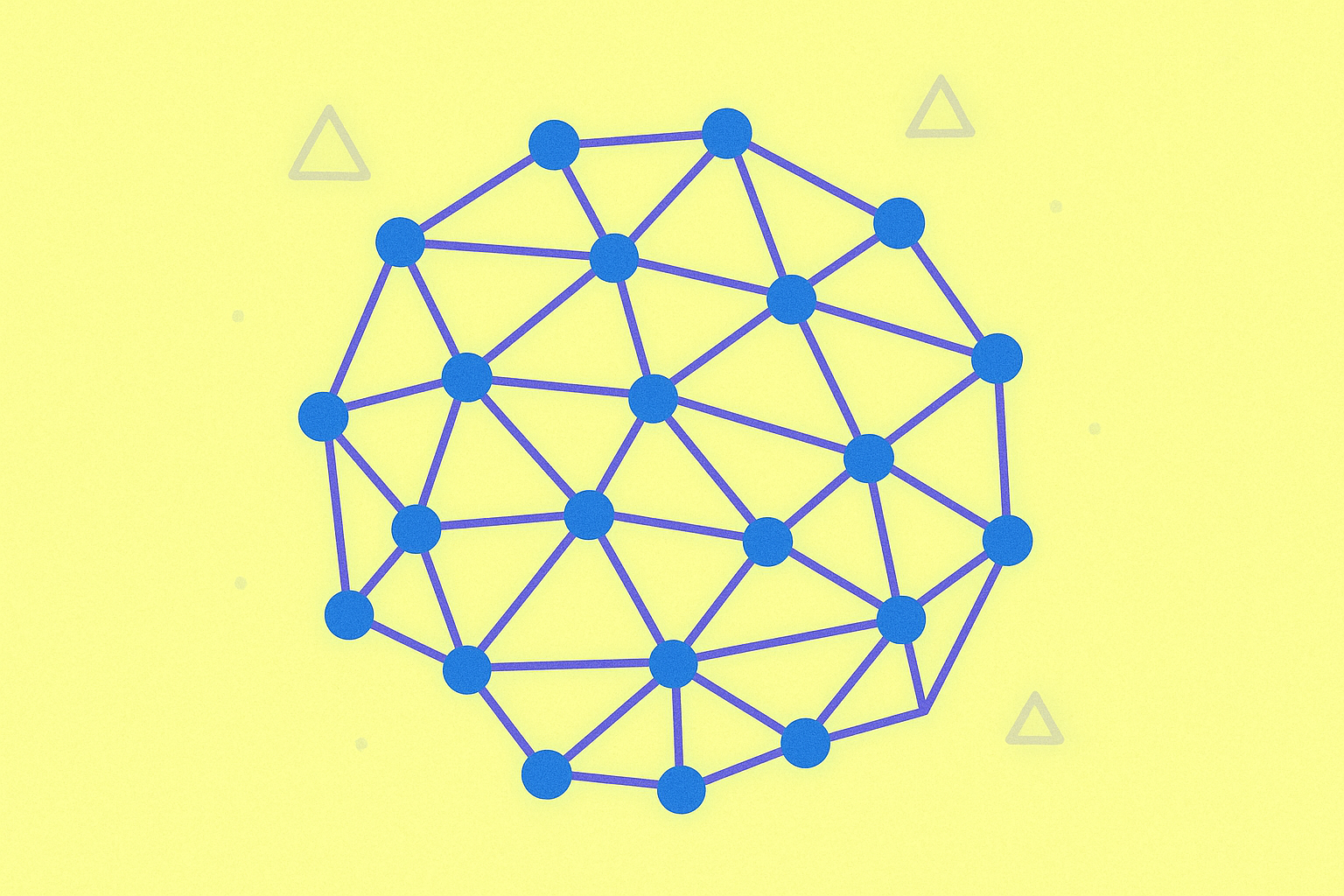

DAG Technology vs. Traditional Distributed Ledger Technology

DAG is a data structure model fundamentally distinct from traditional distributed ledgers. While conventional systems rely on a linear chain of blocks, DAG utilizes a flexible, network-based structure. This architectural difference grants DAG significant speed and efficiency advantages, earning it the reputation of a "formidable rival to traditional distributed ledgers."

DAG Technology Architecture

The DAG framework consists of two core components:

- Vertices (nodes): Represent activities or transactions pending addition to the network.

- Edges (connections): Define the order of transaction confirmations, always pointing in one direction.

This unique architecture enables parallel transaction processing, dramatically accelerating network throughput.

How DAG Technology Works

To initiate a transaction in a DAG-based system, the user must confirm two previous transactions. Unconfirmed transactions are known as "tips." When a new transaction is submitted, it becomes the latest tip, awaiting confirmation from subsequent transactions. This process creates a continuous chain of transactions, safeguarding the network’s integrity and speed.

Applications of DAG Technology

DAG is primarily deployed to optimize transaction processing efficiency. Its key benefits include:

- Transaction speed: No waiting periods for block creation.

- Energy savings: Eliminates reliance on traditional, energy-intensive mining.

- Scalability: The network can simultaneously process a larger volume of transactions.

Examples of Cryptocurrencies Utilizing DAG Technology

Several cryptocurrency projects have implemented DAG technology, including:

- IOTA (MIOTA): Focused on Internet of Things (IoT) and smart city applications.

- Nano: A digital currency designed for instant, feeless transactions.

- BlockDAG: A hybrid solution that merges the strengths of traditional distributed ledgers and DAG technology.

Advantages and Disadvantages of DAG Technology

Advantages:

- Ultra-fast transaction speeds.

- Low or zero fees.

- Significantly reduced energy consumption compared to traditional distributed ledgers.

- High scalability, supporting the processing of large transaction volumes.

Disadvantages:

- Potential decentralization issues, as some nodes may become disproportionately influential.

- DAG technology is not yet extensively tested, raising concerns about its long-term security and reliability.

Conclusion

DAG technology marks a significant advancement in cryptocurrency and fintech. While it delivers promising solutions to some limitations of traditional distributed ledgers—particularly regarding speed and scalability—it is still undergoing development and testing. As DAG continues to evolve, we can expect more innovative applications that could redefine digital transactions. Nevertheless, ongoing evaluation of DAG’s performance and security is essential before widespread adoption.

FAQ

How can I create a chart on my mobile device?

To create a chart on your mobile device, use specialized apps such as TradingView or MetaTrader. Download your preferred app, search for the cryptocurrency, and select the chart type and time interval. Add indicators and analysis tools as needed.

What is a chart?

A chart visually represents the price movements of a cryptocurrency over time. It highlights price trends and helps traders analyze historical performance to make informed decisions.

Guide to Engaging in Parachain Auctions on Polkadot

Understanding Directed Acyclic Graph (DAG)

Understanding Directed Acyclic Graphs in Blockchain Technology

Exploring the Potential of Internet Computer Protocol (ICP)

Introduction to Directed Acyclic Graphs (DAG)

Exploring Distributed Ledgers: A Non-Block Approach

DEX Aggregator Platform Upgrade: Enhanced Trading Experience

Comprehensive Multi-Chain NFT Marketplace

What Is Monad? How to Claim Monad (MON) Tokens Using the Web3 Faucet

Grok AI Adoption: Ushering in a New Era for Blockchain Applications

Top 5 DeSci Crypto Projects Revolutionizing Science in Recent Years